td ameritrade tax rate

LIFO last-in first-out. Open an Account Now.

Td Ameritrade Review 2022 Pros And Cons Uncovered

My bank also charged.

. The tax research solution TTR and Vertex Software may also be used to perform independent research for rules and tax rates. TD Ameritrades policy of not imposing a fee to close an IRA is also very generous. Internal Revenue Service IRS on your behalf so no additional tax is due after.

Please read important additional mutual fund exchange-traded fund and closed-end fund risk disclosures Research and planning tools. OMAHA Neb April 04 2022--The TD Ameritrade Investor Movement Index IMXSM decreased to 642 in March down from 679 in February. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th.

Taxes related to TD Ameritrade offers are your responsibility. On a monthly basis the tax specialist will review the accounts. Mailing date for Forms 4806A and 4806B.

All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the. However I only received 978 in my actual balance.

TD Ameritrade Clients Can Bring Short Sale Tax Suit As Group. How much do you get taxed on TD Ameritrade. Holding period requirements that must be met to be eligible for this lower tax rate.

As of 2020 the tax rates for long-term gains rates range from zero to 20 for long-term held assets depending on your taxable. Options trading subject to TD Ameritrade review and approval. An Ally Invests IRA for example costs 25 to close.

Please consult a tax advisor regarding your personal situation. You may contact the td ameritrade singapore trade desk at 65 6823 2250 to discuss the process. Law360 December 14 2021 401 PM EST -- A Missouri federal judge has certified a class of investors accusing TD Ameritrade.

TD Ameritrade will report a dividend as qualified if it has been paid by a US. TD Ameritrade has settled for 23 million with a certified class of consumers who accused Scottrade a brokerage firm that TD acquired in 2017 of improperly issuing what are. Highest cost may deliver the lowest gains but not the lowest.

Open an Account Now. The UTMA account can hold physical assets like real estate and fine art which arent available at TD Ameritrade. TD Ameritrade does not provide tax advice.

Or qualified foreign corporation. This is Non-Resident Alien NRA withholding that is withheld by TD Ameritrade Singapore and sent to the US. The IRS does not tax the first 1050 in earnings per year in a custodial.

Dividend Income Withholding Rate Most types of US derived income earned by a foreign person is subject to a 30 percent tax rate. Mailing date for Form 1042-S and Real Estate Mortgage Investment ConduitWidely Held Fixed Investment Trust REMICWHFIT. Strategies Rules for Capital Gains Tax on Investments 3 min read.

Ad No Hidden Fees or Minimum Trade Requirements. Td ameritrade risks of investing in funds. Most other brokers do charge something.

Ad No Hidden Fees or Minimum Trade Requirements. Hi I live abroad and I recently wire transfered 1000 from an international bank account to my TD ameritrade account. This may be overridden if your country and.

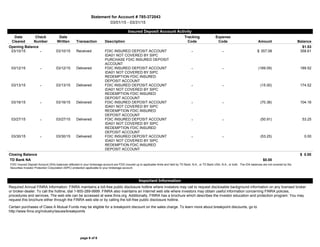

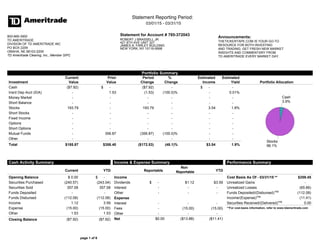

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

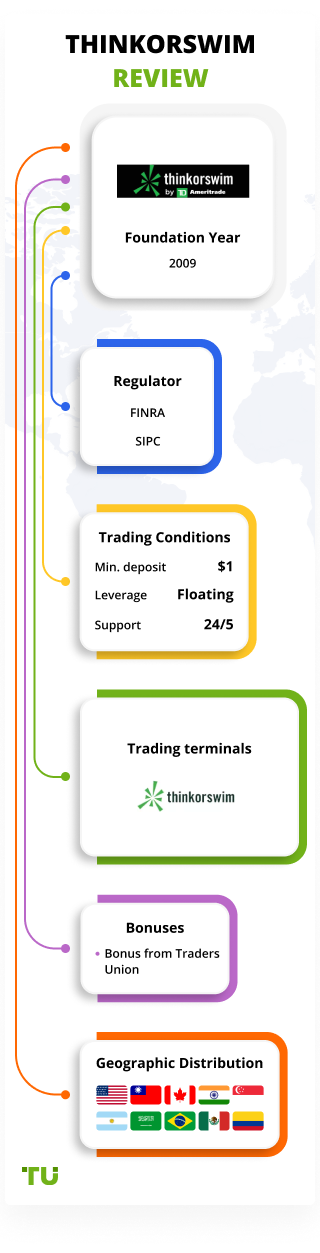

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

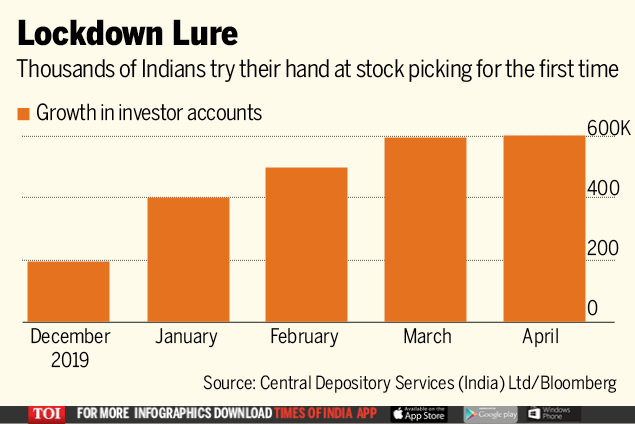

Blue Chip Stocks To Buy Now In India Free Riding Td Ameritrade Rockinpress

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

Top 7 Investment Accounts To Help You Investment Accounts Investing Investing Money

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Td Ameritrade Thinkorswim Review A Comprehensive Write Up On This Zero Cost Brokerage Firm New Academy Of Finance

Disclosures Td Ameritrade Singapore

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

Td Ameritrade Review 2022 Day Trading With 0 Commissions

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

Td Ameritrade 529 College Savings Plan 2022

Best International Online Brokers In 2022 In Thailand Fee Comparison Included

Blue Chip Stocks To Buy Now In India Free Riding Td Ameritrade Rockinpress